search the site

February sees $2.53b remittance inflow, fourth highest in history

The surge in February, which is 25% higher than the amount received in the same month last year, has been attributed to Ramadan, a period when remittance inflows typically rise as expatriates send more money to support their families

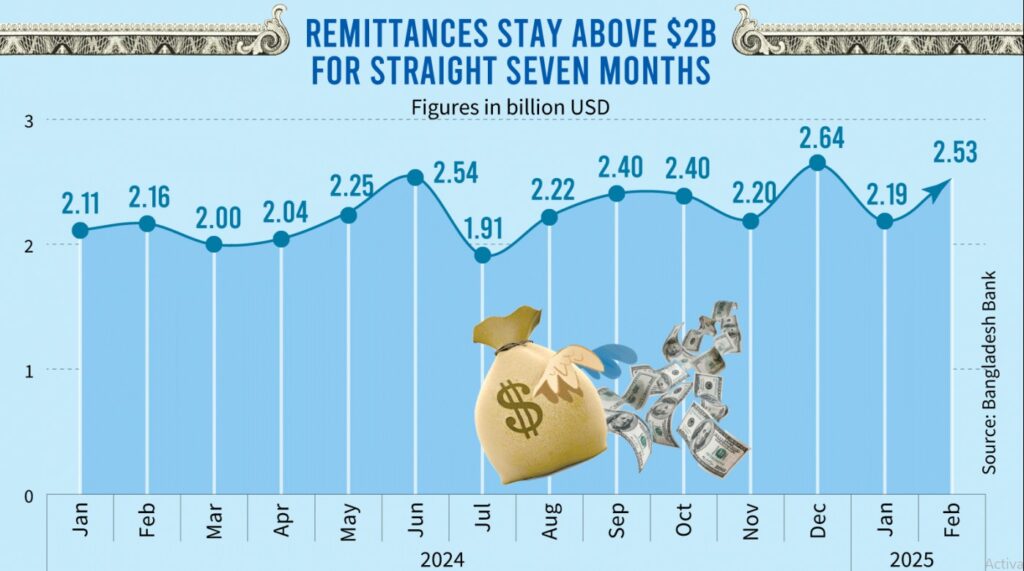

Bangladesh received $2.53 billion in remittances in February — the fourth highest monthly inflow in the country’s history.

The country recorded its highest-ever monthly remittance inflow of $2.64 billion in December last year. The second-highest inflow of $2.59 billion was recorded in July 2020 and the third highest of $2.54 billion was recorded in June 2024, according to central bank data.

Arif Hossain Khan, spokesperson and executive director of Bangladesh Bank, told The Business Standard, “The central bank is making every effort to boost remittance inflow. Alongside, both state-owned and private banks are also working to strengthen ties with local and foreign exchange houses to increase remittance flow.”

“However, the primary contributors behind the over $2.5 billion remittance inflow in February are patriotic expatriates who are now prioritising formal channels for sending remittances. Banks are also actively encouraging expatriates to use legal channels,” he added.

Mentioning that the higher remittance inflow will strengthen the country’s external balance, Arif further said, “Our balance of payments’ current account had been in deficit for long, but it turned into a surplus in December. If this upward trend continues, our external balance will improve further, easing pressure on foreign exchange reserves.”

According to the central bank, from July to February of the current fiscal year, total remittance inflow reached $18.49 billion, reflecting a 23.8% increase compared to the $14.94 billion received during the same period last fiscal year.

The February inflow alone was 25% higher than the same month last year, when $2.02 billion was recorded. The surge has been attributed to the month of Ramadan, a period when remittance inflows typically rise as expatriates send more money to support their families.

Md Shawkat Ali Khan, CEO and managing director of Sonali Bank, told TBS, “Remittance inflow usually increases in the month before Ramadan, as expatriates send money to their families and relatives ahead of the holy month. Following this trend, remittance inflow saw a significant rise in February this year.

He also noted that a narrowing gap between the official exchange rate and the informal hundi rate encouraged more expatriates to use legal banking channels.

“Demand for dollars in hundi transactions has declined significantly, and with competitive exchange rates, expatriates are opting for formal channels,” he added.

According to several senior bank officials, remittance inflows remained relatively stable throughout February, aided by Bangladesh Bank’s tight control over exchange rates.

At the end of January, the remittance dollar rate hit an all-time high of Tk128, twice, but strict intervention by the central bank brought it down to below Tk122 in the first week of February.

The central bank had verbally instructed banks not to buy or sell remittance dollars at rates above Tk122.

However, later, the rate increased slightly, with current transactions taking place at around Tk122.60–Tk122.70 per dollar.