For a long time, dry bulk ship owners were looking ahead to 2017-2018 as the years during which they could enjoy the benefits of the market’s rebalancing and see freight rates recover above break-even point, for a first time in years. However, few – if anyone – could have predicted that the world economy would be faced with the prospect of a trade war on a global scale, between the two biggest economies, US and China. The implications could be devastating for shipping in general, both dry bulk and containers, as the industry needs world trade to prosper, not the opposite.

For a long time, dry bulk ship owners were looking ahead to 2017-2018 as the years during which they could enjoy the benefits of the market’s rebalancing and see freight rates recover above break-even point, for a first time in years. However, few – if anyone – could have predicted that the world economy would be faced with the prospect of a trade war on a global scale, between the two biggest economies, US and China. The implications could be devastating for shipping in general, both dry bulk and containers, as the industry needs world trade to prosper, not the opposite.

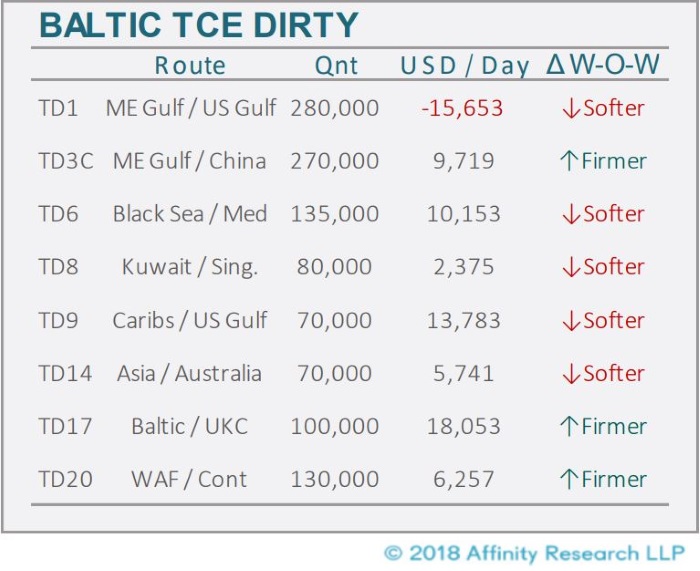

In a recent note, shipbroker Affinity Research said that “after dabbling in international relations, the leader of the free world takes another stab at reducing the US deficit. By now you’ve heard it before. “Last year, we lost USD 500 billion on trade with China,… We can’t let that happen.“, though at the time it was unclear what figure President Trump was citing, given America’s trade deficit with China has never climbed past USD 375 Bn. The notion that trade deficits suggest other countries are taking advantage of the US is simplistic at best. While most economists do not see a trade gap as money “lost”, we won’t try to cover the full extent of the arguments against the President’s understanding of international trade. Suffice it to say, some of the macroeconomic factors that play a role include the relative growth rates of countries, the value of their respective currencies, savings and investment rates etc. Fun fact, during the Great Recession America’s trade deficit narrowed dramatically as national consumption fell flat”.

According to Affinity Research, “the reason this all matters for us in shipping relates of course to the policies arising from the attempt at fixing this perceived problem. At the time of writing the US has nearly completed a second list of tariffs on USD 100 Bn worth of a variety of Chinese goods. While efforts have been taken to target goods where substitutes from other countries are available, thus minimising the impact on US consumers, a potential retaliation from China is likely to further target US agricultural exports to the country. China has reiterated it’s preference for dialogue to resolve differences, while also publishing its own list of potential tariffs, covering soybeans, aircraft and cars, to hit back should Washington follow with further measures”.

The shipbroker added that “considering that the US supplied China with 32.8 Mn tonnes of soybeans in 2017, estimated at a value of USD 13.9 Bn, there is little doubt that China’s leverage in any escalation of a trade-war is substantial. While US exports would still find a market, the availability of Soybeans out of the ECSA in particular makes Soy a prime target. Whether Washington goes ahead with this second round of tariffs will therefore matter for trade flows going forward. However, considering the upcoming US mid-term election one have to ask whether a show of strength from Trump towards China at this stage is worth the risk of reciprocal tariffs effectively targeting the agricultural heartland of Trump’s fan base”, Affinity Research concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide